Single paycheck tax calculator

Your average tax rate. All Services Backed by Tax Guarantee.

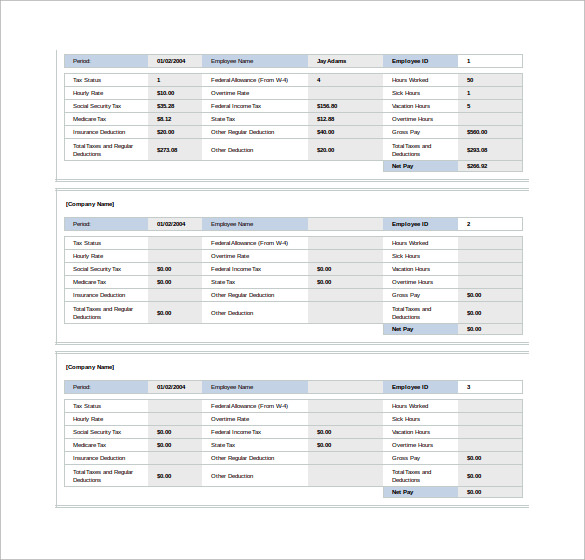

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Ad Fast Easy Accurate Payroll Tax Systems With ADP.

. That means that your net pay will be 43041 per year or 3587 per month. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Learn About Payroll Tax Systems.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. The state tax year is also 12 months but it differs from state to state. The calculator will calculate tax on your taxable income only.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions.

Important note on the salary paycheck calculator. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Estimate your federal income tax withholding.

Free salary hourly and more paycheck calculators. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Sign Up Today And Join The Team. Over 900000 Businesses Utilize Our Fast Easy Payroll.

See how your refund take-home pay or tax due are affected by withholding amount. You can enter your current payroll information and deductions and. Run your own payroll in.

Discover The Answers You Need Here. Ad Payroll So Easy You Can Set It Up Run It Yourself. Sign Up Today And Join The Team.

However federal income and FICA Federal Insurance Contribution Act taxes are unavoidable no matter where you work. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Over 900000 Businesses Utilize Our Fast Easy Payroll.

The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets. Use this tool to. It can also be used to help fill steps 3 and 4 of a W-4 form.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Some states follow the federal tax. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Learn About Payroll Tax Systems. Washington state does not impose a state income tax.

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes Methods Examples More

Payroll Tax Calculator For Employers Gusto

How To Calculate Federal Income Tax

Tax Payroll Calculator On Sale 53 Off Www Wtashows Com

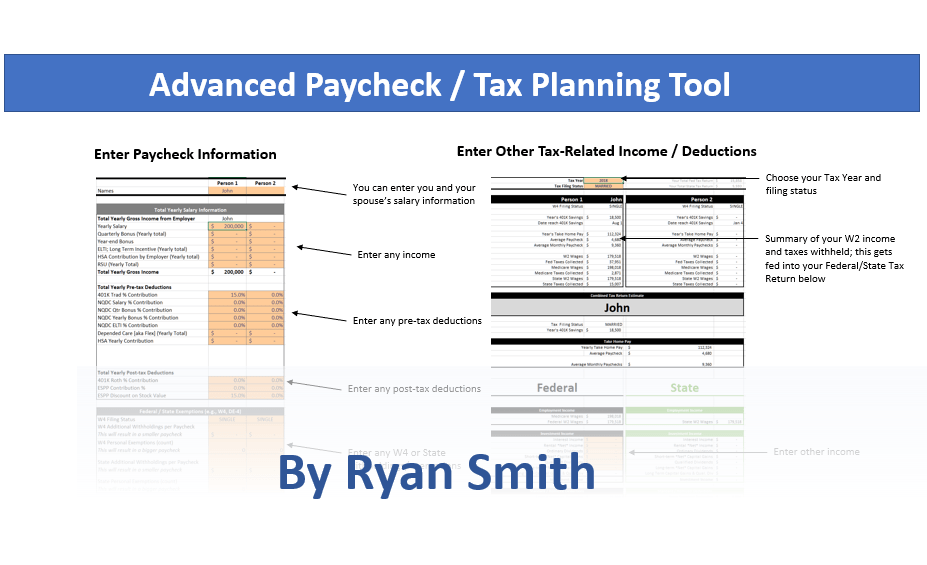

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate 2019 Federal Income Withhold Manually

Payroll Tax Calculator Shop 55 Off Www Wtashows Com

2 My Paycheck My Future Self Portfolio

Tax Payroll Calculator On Sale 55 Off Www Wtashows Com

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Tax Payroll Calculator On Sale 55 Off Www Wtashows Com

How To Calculate Federal Withholding Tax Youtube

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Online For Per Pay Period Create W 4

Free Online Paycheck Calculator Calculate Take Home Pay 2022